May 2024 Saving Tool UK Update

Today, we are pleased to share several updates for Saving Tool UK.

2024/25 Rates Applied

Following on from the January 2p cut, the April 2024/25 2p National Insurance cut has now been applied to the Saving Tool Advanced simulation and the Saving Tool UK Tax Calculator. All scenarios will see a beneficial impact vs 2023/24, particularly over the long term.

The State Pension weekly full amount has been updated from £203.85 to £221.20.

Interest Rates on Student Loans (Plan 2, Plan 5, Postgrad) have been updated from 7.5% to 7.8% (Advanced only).

Simulation Accuracy Improved

Previously, the simulation was erroneously deducting National Insurance contributions (NICs) (a) from pension drawdown income at any age and (b) from all income sources past state pension age. Both issues have been fixed in this update. Scenarios are likely to see a slight improvement from age 55+, depending on pension drawdowns.

Under-the-hood limits were also increased to allow for scenarios containing very large incomes of £1m+.

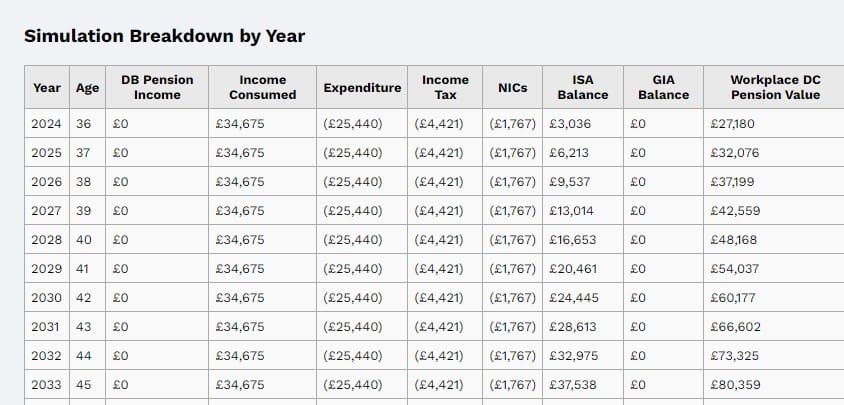

Taxes Added to Breakdown Table

The full simulation breakdown table on the Saving Tool Advanced dashboard has been updated to output Income Tax and NICs for each year.

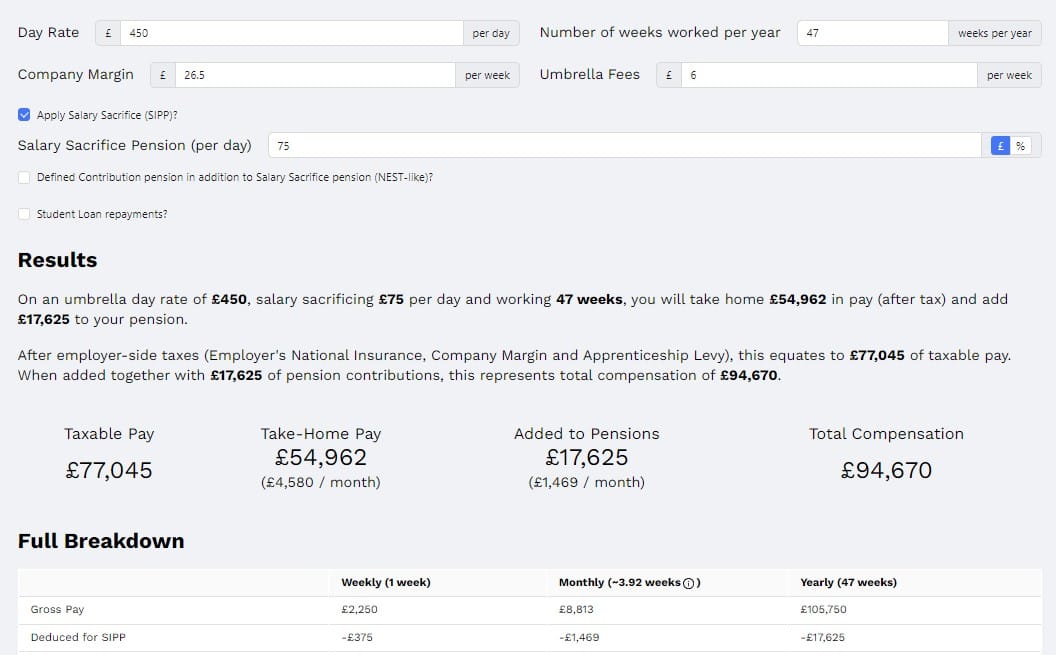

New Umbrella Calculator

Contactors operating via an umbrella company (typically for contract positions deemed inside IR35) can benefit from a new Umbrella Calculator, our experimental new tool designed to help estimate a contractors full-year income.

The umbrella calculator allows for a SIPP and factors in all fees and taxes such as Company Margin, Umbrella Fees, Income Tax, Employer and Employee NI and more. Users can also define an auto-enrolment style pension in addition to SIPP.

Try the new Umbrella Calculator here.

You can also read more about Making sense of UK Umbrella Contract Rates.

Building in Public

As Saving Tool UK grows, there is an opportunity to get involved and influence what features we build next. You can now view our public roadmap to upvote, suggest and comment on new features.

Under consideration are features like Pension Tapering, Custom Growth Curve, Future Income Changes and more. Coming soon is support for Scottish taxes.

Run your scenarios on Saving Tool Advanced now to see all the latest changes applied.